Things about Summitpath Llp

Things about Summitpath Llp

Blog Article

Getting My Summitpath Llp To Work

Table of ContentsThe Best Guide To Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is Talking AboutThe Definitive Guide to Summitpath Llp6 Easy Facts About Summitpath Llp Described

Most lately, released the CAS 2.0 Technique Growth Coaching Program. https://sandbox.zenodo.org/records/279389. The multi-step mentoring program includes: Pre-coaching placement Interactive group sessions Roundtable conversations Embellished mentoring Action-oriented mini prepares Firms looking to increase into advising solutions can additionally turn to Thomson Reuters Technique Onward. This market-proven technique uses content, tools, and guidance for companies interested in advisory servicesWhile the changes have opened a number of development possibilities, they have also resulted in difficulties and concerns that today's firms need to carry their radars. While there's variance from firm-to-firm, there is a string of usual difficulties and problems that often tend to run industry vast. These include, however are not limited to: To stay competitive in today's ever-changing regulative environment, firms need to have the capability to rapidly and efficiently perform tax study and enhance tax reporting efficiencies.

On top of that, the brand-new disclosures may cause a rise in non-GAAP measures, historically a matter that is very inspected by the SEC." Accountants have a great deal on their plate from regulatory modifications, to reimagined organization designs, to a rise in client expectations. Equaling it all can be difficult, but it doesn't need to be.

Getting My Summitpath Llp To Work

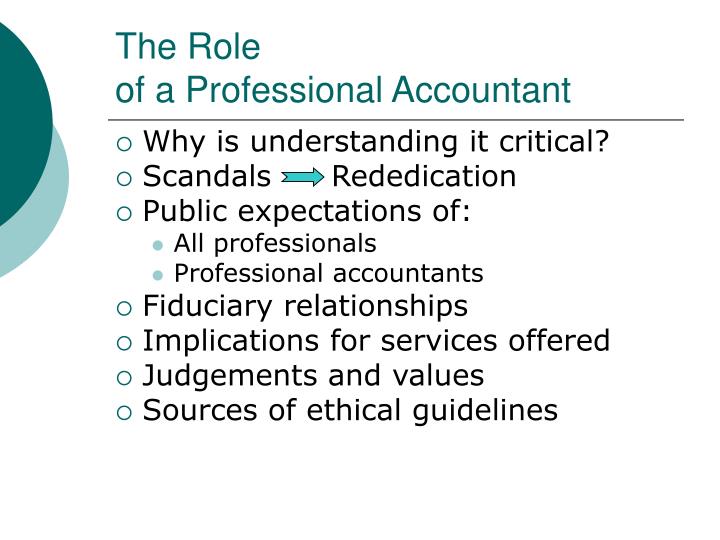

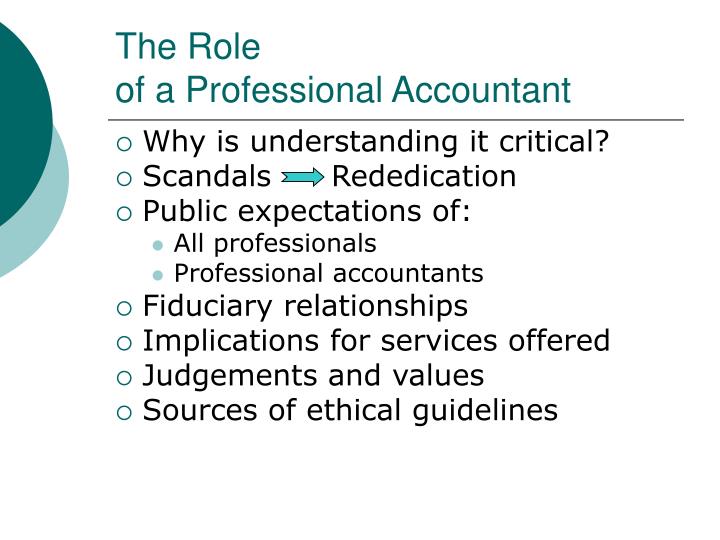

Below, we define four certified public accountant specializeds: taxes, monitoring bookkeeping, monetary coverage, and forensic accountancy. CPAs specializing in taxes assist their customers prepare and file income tax return, reduce their tax worry, and prevent making blunders that might cause pricey fines. All Certified public accountants require some knowledge of tax legislation, yet focusing on taxes implies this will be the emphasis of your job.

Forensic accountants generally begin as general accounting professionals and relocate into forensic bookkeeping roles over time. They need solid analytical, investigative, company, and technical bookkeeping abilities. Certified public accountants who concentrate on forensic bookkeeping can often go up into administration audit. CPAs require at the very least a bachelor's level in accountancy or a similar field, and they have to finish 150 credit report hours, including audit and business courses.

No states require a graduate level in audit., bookkeeping, and taxes.

Accountancy likewise makes functional sense to me; it's not simply theoretical. The CPA is a crucial credential to me, and I still get continuing education and learning debts every year to maintain up with our state demands.

Get This Report on Summitpath Llp

As a freelance specialist, I still use all the standard foundation of accounting that I found out in university, pursuing my CPA, and working in public bookkeeping. Among things I actually like concerning bookkeeping is that there are various jobs available. I chose that I wished to start my occupation in public accountancy in order to find out a lot in a brief duration of time and be subjected to various sorts of customers and different areas of bookkeeping.

"There are some work environments that don't intend to think about someone for an accounting duty who is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A certified public accountant is an extremely important credential, and I intended to place myself well in the industry for various work - tax planning. I made a decision in university as a bookkeeping significant that I intended to attempt to get my certified public accountant as quickly as I could

I've satisfied a lot of excellent accountants that do not have a CERTIFIED PUBLIC ACCOUNTANT, but in my experience, having the credential truly assists to advertise your experience and makes a distinction in your settlement and job options. There are some work environments that do not wish to consider someone for an accountancy role that is not a CERTIFIED PUBLIC ACCOUNTANT.

The Ultimate Guide To Summitpath Llp

I actually appreciated functioning on different types of projects with different clients. In 2021, I determined to important source take the next action in my audit job trip, and I am now a freelance bookkeeping consultant and service expert.

It remains to be a growth location for me. One important quality in being a successful CPA is truly respecting your clients and their organizations. I love collaborating with not-for-profit customers for that really factor I seem like I'm actually adding to their mission by helping them have great financial info on which to make smart business choices.

Report this page